Chairman's message

Dear Shareholders

I am pleased to introduce the Group's corporate governance report on behalf of our Board of Directors. The Corporate governance statement provides an insight into how the Board operated during the year and the key issues considered. We are committed to conducting business responsibly. By maintaining high standards of corporate governance we enhance performance underpinned by our business model. Our approach to governance is set by the Board and our Executive Committee ensures that the approach is effectively implemented across the business. Effective and robust governance remains central to the ongoing success of the Group.

The main Group-wide governance documents are our Core Values and the Code of Conduct, which set out the values and standards that we expect of our employees. These documents, together with our policies, govern how we conduct our business and set the standards that drive performance. Compliance training helps to enforce this. Board oversight, reviews and audits form part of the monitoring and supervision process. Risk processes are embedded and reviewed on an ongoing basis across the business. The important governance developments at Bodycote over the last year are detailed in the governance reporting section below.

My ambitions for the composition of the Board are to maintain, and where applicable, broaden the range of expertise, experience and diversity. The Board continues to ensure that effective succession plans are in place.

I encourage all shareholders to attend the AGM, which will be held at our Macclesfield head office on 30 May 2018. This event provides an excellent opportunity to meet the executive and independent non-executive directors.

Board performance

| 2017 key actions | 2017 achievements | Priorities for 2018 |

- Implement actions from the 2016 strategy review

| - Undertook 2017 strategy review

| - Undertake 2018 strategy review

|

- Continued focus on management development and succession planning

| - The Board and management reviewed management resources during the year

| - Continue succession planning and management development

|

- Smooth transition following handover of the Chief Financial Officer role from D. Landless to D. Yates and search for a new Non-Executive Director and Chairman

| - A.C. Quinn was appointed as Non-Executive Director and Chairman effective 1 January 2018 and L. Chahbazi was appointed as Non-Executive Director also effective 1 January 2018

| - Smooth transition following handover of the Chairman role from A.M. Thomson to A.C. Quinn

|

- Continued emphasis on external Board training and development

| - The Board visited plants in France and the USA during the year and developed the directors' understanding of these businesses and the markets they serve

| - Use Board visits to meet the operating teams to promote understanding of markets and the opportunities they offer

|

- Continued review of the risk register, including major programme risks

| - During the year the Board reviewed the different elements of the Group's risk management framework and how it discharged its responsibilities

| - The Board will continue to review cyber security protection, the management of risk in major programmes and crisis management

|

Governance reporting

Board diversity

Bodycote is a global business with operations in 23 countries and diversity is an integral part of how we do business. The Nomination Committee considers diversity when making appointments to the Board, taking into account relevant skills, experience, knowledge, personality, ethnicity and gender. Our prime responsibility, however, is the strength of the Board and our overriding aim in any new appointment must always be to select the best candidate. The Nominations Committee also considers capability and capacity to commit the necessary time to the role in its recommendation to the Board. The intention is to appoint the most suitable qualified candidate to complement and balance the current skills, knowledge and experience of the Board and who will be best able to help lead the Company in its long-term strategy. The Nomination Committee is advised by international search companies, who have been briefed on our diversity policy and are required to reflect the policy in the long list submitted to the Committee.

We appointed A.C. Quinn on 1 January 2018 as part of our Board refreshment replacing A.M. Thomson, who retired on 31 December 2017 as Chairman of the Board. L. Chahbazi was appointed Non-executive director effective 1 January 2018. The Board currently comprises two executive directors, four non-executive directors and a non-executive chairman.

As of 2018 female representation on our Board is 43%; 2017: 17% (2016: 17%). At manager level it is 26% (2016: 25%). Females represent 19% (2016: 18%) of our total workforce. Whilst we are above the 33% by 2020 voluntary target recommended by the Hampton-Alexander review, we continue to believe it is difficult to set targets or timescales for increasing the proportion of women, or any other minority group, on our Board and do not propose to do so. We will increase female and/or other minority representation on the Board if appropriate candidates are available when Board vacancies arise.

The Corporate responsibility and sustainability report contains further details regarding the male and female representation within the Group, including Board representation.

Board evaluation

Following the external Board Evaluation in 2015, the Board agreed to undertake an internal evaluation in 2017. To ensure that all aspects of good governance are covered by the review, the Group Company Secretary distributed a tailored questionnaire to each member of the Board. Questions were framed under the following seven topics:

- Remit and objectives;

- Composition, training and resources;

- Corporate governance/risk management;

- Stakeholder engagement;

- Board meetings and visits;

- Board procedures and administration; and

- Evaluation and effectiveness.

At a meeting of the Nomination Committee in September 2017, the directors assessed the conclusions reached and are in the process of implementing a number of recommendations. Additional emphasis will be placed on risk management, strategy and operational matters. The Board evaluation covered the activities of the main Board and each of its Committees. The Board is considered to be functional and working well. Arising from the exercise, the Board concluded that its focus should remain on divisional growth strategies, technology development, risk and sustainability as well as continued training. The overall conclusion is that the Board is performing well and high governance standards have been adopted. The Executive Committee is strongly challenged by the Board when appropriate.

As in previous years, the Chairman has assessed the performance of each Board member by conducting individual interviews and we can confirm that all directors continue to perform effectively and demonstrate commitment to their roles.

The Executive Directors Messrs S.C. Harris and D.Yates will be appraised in March 2018.

Led by the Senior Independent Non-Executive Director, the directors carried out an evaluation of the Chairman's performance in September 2017. The Board was satisfied with the now retired Chairman's commitment and performance.

Overboarding

At our AGM in 2017, Bodycote received a high number of votes against the re-election of Eva Lindqvist. Eva has now had time to review her directorships and will not stand for re-election at three of her listed companies. RNS announcements will be made during Q1 2018 confirming that Eva will not stand for re-election at the AGMs of Caverion Oy in March 2018, Assa Abloy AB in April 2018 and Alimak Holding in May 2018.

Following these changes, Eva Lindqvist will sit on five listed boards: Bodycote, another UK PLC and three Nordic Boards. Following a review of Eva's time commitments and taking into account the reduced number of meeting of Nordic Boards, the Board is satisfied that Eva has sufficient scope to carry out her commitments even if these should be temporarily increased.

Induction

All new directors are subject to a tailored induction programme covering a diverse range of topics including trading, investor relations, organisational and legal matters as well as visits to operational sites. They also meet all other directors and senior executives. This facilitates their understanding of the Group and the key drivers of business performance.

Training

The Board receives training via ad hoc presentations and papers from advisers and the Group Company Secretary. External periodic training on important topics takes place and during the year the directors received training on Stakeholder engagement, FRC consultation on the UK Corporate Governance Code, FRC updates to the guidance on the Strategic Report and other areas of focus for 2017/18. Other opportunities for on-going development and support are:

- a programme of plant/site visits throughout the year;

- reviews with the Chairman to identify any training and development needs;

- advice on governance, relevant legislative changes affecting the business or their duties from the Company Secretary;

- access to independent professional advice at the Company's expense; and

- participation in the training and guidance programme for boards and directors offered at the Deloitte Academy.

Succession planning

Succession planning ensures that appropriate senior executive leadership resources are in place to achieve Bodycote's strategic objectives. The plans are reviewed annually by the Nomination Committee.

The Board further develops its knowledge and gains greater visibility of executive talent and management succession by visiting the Group's sites and meeting with key talent and senior executives.

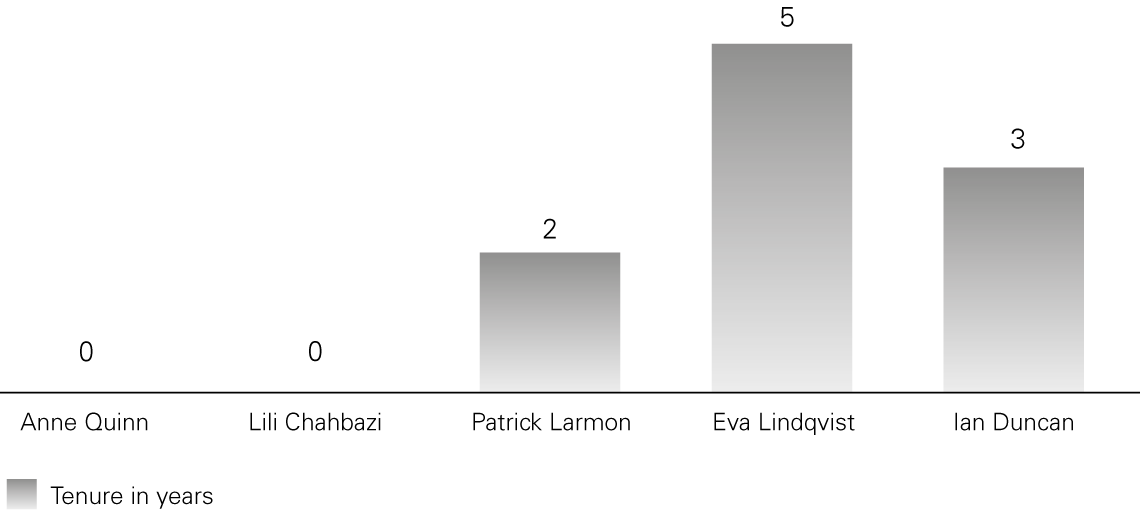

Non-executive tenure

(in years)

Individual roles of the Board

Chairman

- leadership and governance of the Board and chairs the Nomination Committee

- Board effectiveness

- ensures members receive accurate, timely and clear information on Board issues

- ensures, together with the Group Company Secretary, comprehensive induction of new directors

- sets Board agenda, style and tone of Board discussions

- ensures effective communication with shareholders

Group Chief Executive

- overall responsibility and leadership of the Group performance

- stewardship of Group assets

- plans and executes objectives and strategies

- maintains a close working relationship with the Chairman, ensuring effective dialogue with investors and stakeholders

- ensures the leadership and development frameworks are developed to generate a positive pipeline for future opportunities for the Group

- has overall responsibility for the Group's sustainability performance

- communicates the vision and values of the Group

- manages the senior management team

Chief Financial Officer

- maintains strong financial management and implements effective financial controls

- provides financial and commercial decision leadership, vision and support

- ensures the appropriateness of risk management systems

- oversees all aspects of accounting/finance operations including accounting policies and integrity of financial data and external financial reporting

- responsible for corporate finance functions, financial planning and budget management

- supports and advises the senior management team

- leads the development of investor relations strategy and communications

Senior Independent Director

- acts as a sounding board for the Chairman

- serves as an intermediary for other directors

- is available to meet shareholders if they have concerns which they have not been able to resolve through the normal channels

- conducts an annual review of the performance of the Chairman and convenes a meeting of the non-executive directors to discuss the same

Non-Executive Directors

- provide constructive challenge

- help develop strategy

- ensure financial controls and systems of risk management are robust and defensible

- determine appropriate levels of remuneration for the executive directors

- monitor reporting of performance

- scrutinise performance of management

- are available to meet with major shareholders

Group Company Secretary

- secretary to the Board and its committees

- ensures efficient information flows within the Board and its committees and between senior management and non-executive directors

- facilitates induction of new directors and assists with training and development needs as required

- regularly updates the Board on corporate governance matters, legislative changes and regulatory regimes affecting the Group

- ensures compliance with Board procedures

- co-ordinates external Board evaluation and conducts internal Board evaluation

Core values

The Board acknowledges its responsibility for determining and maintaining the Group's values and ensures these are reflected in the business practices. This is monitored by the Board at regular intervals. Further details are available in the Corporate responsibility and sustainability.

Pre-emption rights

In line with best practice provisions in the Pre-Emption Group Statement of Principles, the Board confirms that it does not intend to issue more than 7.5% of the issued share capital of the Group on a non pre-emptive basis in any rolling three-year period.

Compliance reporting

In respect of the financial year 2017, Bodycote's obligation under the Disclosure and Transparency Rules is to prepare a corporate governance statement with reference to the UK Corporate Governance Code issued by the FRC in April 2016 ("the Code").

In respect of the year ended 31 December 2017, Bodycote has complied with the provisions of the Code with the exception of provisions E.1.1. Regarding E.1.1, the Board has, in recent years, taken the view that generally it is the responsibility of the Group Chief Executive and the Chief Financial Officer to manage relationships with institutional investors. The Chairman also meets institutional investors to discuss overall strategy, governance and any concerns that shareholders may have. Only where these more usual channels of communication have failed would the Board expect the Senior Independent Non-Executive Director (SID) or other non-executive directors to become involved, notwithstanding that the Code specifies attendance of the SID at meetings with major shareholders. The SID has contacted major shareholders and offered to facilitate meetings with them should they have any concerns they wish to discuss. Regular feedback from the Group's advisers on investor meetings and results presentations is circulated to all directors. During the year the Chairman met with shareholders to discuss governance matters.

Apart from these distinct areas, Bodycote was in compliance with the provisions of the 2016 Code throughout 2017.

Operation of the Code

Taken together with the Report of the Audit Committee, the Report of the Nomination Committee and the Board report on remuneration, this statement explains how Bodycote has applied the principles of good corporate governance as set out in the Code.

Leadership

The Board is responsible to shareholders for good corporate governance, setting the Group's strategic objectives, values and standards, and ensuring the necessary resources are in place to achieve the objectives.

The Board met on nine occasions during 2017, including a specific meeting to review and update the Group's long-term strategy. The Board of Directors comprises seven members, of whom five are non-executive directors and two are executive directors, led by the Group's part-time Non-Executive Chairman, A.C. Quinn, who also chairs the Nomination Committee. The Group Chief Executive is S.C. Harris and the Senior Independent Non-Executive Director is I.B. Duncan, who also chairs the Audit Committee. E. Lindqvist is Chair of the Remuneration Committee. P. Larmon and L. Chahbazi are non-executive directors. Brief biographical details of all directors are given in the Board of Directors. During the year the Board visited a number of UK and overseas facilities, including sites in France and the USA. Such events involved meetings with local management and the unit workforce to understand more clearly technical and operational performance in countries where Bodycote has a significant presence.

Matters reserved for the Board were reviewed during the year and updated where required. Certain defined powers and issues reserved for the Board to decide are, inter alia:

- Strategy;

- Approval of financial statements and circulars;

- Capital projects, acquisitions and disposals;

- Annual budgets;

- Directors' appointments, service agreements, remuneration and succession planning;

- Policies for financial statements, treasury, safety, health and environment, donations;

- Committees' terms of reference;

- Board and committee chairmen and membership;

- Investments;

- Equity and bank financing;

- Internal control and risk management;

- Corporate governance;

- Key external and internal appointments; and

- Employee share incentives and pension arrangements.

In advance of Board meetings, directors are supplied with up-to-date information regarding the trading performance of each operating division and sub-division, in addition to the Group's overall financial position and its achievement against prior year results, budgets and forecasts. They are also supplied with the latest available information on safety, health and environmental and risk management issues and details of the safety and health performance of the Group, and each division, in terms of severity and frequency rates for accidents at work. Senior management from across the Group and advisers attend some of the meetings to provide updates. The exposure to members of senior management from across the Group helps enhance the Board's understanding of the business, the implementation of strategy and the changing dynamics of the markets in which the Group operates.

Where required, a director may seek independent professional advice, the cost of which is reimbursed by the Group. All directors have access to the Group Company Secretary and they may also address specific issues with the SID. In accordance with the Articles of Association, all newly appointed directors must submit themselves for election. All directors stand for yearly re-election. Non-executive directors, including the Chairman, are appointed for fixed terms not exceeding three years from the date of first election by shareholders, after which the appointment may be extended by mutual agreement. A statement of the directors' responsibilities is set out in the Directors' responsibilities statement. The Board also operates three committees. These are the Nomination Committee, the Remuneration Committee and the Audit Committee. All non-executive directors serve on each Board Committee.

In accordance with the recommendations of the Code, Board members serve for a period of six years, which will only be extended in certain circumstances. If letters of appointment are extended beyond six years, the fixed term is reduced to one year.

In order that necessary actions can be taken promptly, a finance sub-committee, comprising the Chairman (or failing her, any other non-executive director), the Senior Independent Director, the Group Chief Executive and the Chief Financial Officer operates between the dates of scheduled Board meetings and is authorised to make decisions, within limits defined by the Board, in respect of certain finance, treasury, tax or investment matters.

The Chairman – key responsibilities

- Effective running of the Board

- Guidance to Executive Directors

- Monitors progress of strategy and objectives

- Safeguards the interests of shareholders

The Board – key responsibilities

- Overall direction of the Group's strategy and the long term success of the Group's business

Audit Committee

Monitors the integrity and effectiveness of the Group's financial reporting and performance of audits and risks

Nomination Committee

Ensures an effective Board that consists of individuals with the correct balance of skills, knowledge and experience

Remuneration Committee

Determines remuneration policy and senior executives' remuneration packages

Finance Committee

Implementation of treasury and tax policies and, within limits defined by the Board, to authorise capital expenditure and to allot shares

Chief Executive

Responsible for running the Group's business, interfaces with shareholders and analysts, and oversees health and safety as well as environmental matters

Executive Committee

Focus on the implementation of the Group's strategy, financial structure, organisational development and policies as well as review of financial performance

Independence of non-executive directors

The Board considers that P. Larmon, E. Lindqvist, I.B. Duncan and L. Chahbazi are all independent for the purposes of the Code. The Chairman was considered independent upon appointment.

Commitment

Attendance of directors at regular scheduled meetings of the Board and its Committees is shown in the table below:

| Full Board | Audit Committee | Remuneration Committee | Nomination Committee |

|---|

| Director | Eligible | Attended | Eligible | Attended | Eligible | Attended | Eligible | Attended |

|---|

| A.M. Thomson1 | 9 | 9 | – | – | 4 | 4 | 7 | 7 |

| S.C. Harris2 | 9 | 9 | – | – | – | – | 4 | 4 |

| E. Lindqvist | 9 | 9 | 4 | 4 | 6 | 6 | 7 | 7 |

| I.B. Duncan | 9 | 9 | 4 | 4 | 6 | 6 | 7 | 7 |

| P. Larmon | 9 | 9 | 4 | 4 | 6 | 5 | 7 | 7 |

| D. Yates | 9 | 9 | – | – | – | – | – | – |

- A.M. Thomson resigned from the Remuneration Committee on 24 July 2017.

- S.C. Harris resigned from the Nomination Committee on 24 July 2017.

All directors, attended the maximum number of Board, Audit and Nomination Committee meetings that they were scheduled to attend. P. Larmon did not attend one Remuneration Committee due to an unpredictable diary clash. In addition, non-members Messrs A.M. Thomson, S.C. Harris, D.Yates attended by invitation some parts of the meetings of the Audit, Nomination and Remuneration Committees.

Proposals for re-election

The Board decided, in line with the Code, that all directors will retire annually and, other than in the case of any director who has decided to stand down from the Board, will offer themselves for re-election at the AGM. Accordingly, S.C. Harris, E. Lindqvist, P. Larmon, I.B. Duncan and D. Yates will stand for re-election at the AGM in May 2018. Having been appointed since the last AGM, A.C. Quinn and L. Chahbazi will stand for election.

The Board recommends to shareholders that they re-elect (or elect) all the directors. In accordance with the recommendations of the Code, Board members will serve for a period of six years which may be extended in certain circumstances.

The performance of each director was evaluated as indicated above and the Board confirms in respect of each that their performance continues to be effective and that each continues to demonstrate commitment to his or her respective role.

Internal control and risk management

The Board is responsible for the Group's system of internal controls and risk management policies and has an ongoing responsibility for reviewing its effectiveness. Such a system is designed to manage rather than eliminate the risk of failure to achieve business objectives and can only provide reasonable and not absolute assurance against material misstatement or loss. The Board has applied Principle C.2 of the Code by establishing a continuous process for identifying, evaluating and managing the Group's significant risks, including risks arising out of Bodycote's corporate and social engagement. The Board's monitoring covers all controls, including financial, operational and compliance controls and risk management systems. It is based principally on reviewing reports from management and from Internal Audit (IA) to consider whether any significant weaknesses are promptly remedied or indicate a need for more extensive monitoring. The Audit Committee assists the Board in discharging these review responsibilities.

The Board believes that the Group maintains an effective system of internal controls which is in accordance with the FRC's guidance entitled 'Internal Control: Revised Guidance for Directors' (formerly referred to as the Turnbull Report guidance) and, in the view of the Board, no significant deficiencies have been identified in the system. The system was in operation throughout 2017 and continues to operate up to the date of the approval of this report. Key elements of the Group's system of internal control are as follows:

- The Group prepares a comprehensive annual budget which is closely monitored and updated quarterly. The Group's authority matrix was reviewed and updated during 2017 and this clearly sets out authority limits for those with delegated responsibility and specifies what can only be decided with central approval.

- The Board, with the assistance of EY, who provide co-sourced IA services, monitors the Group's internal financial control system. IA reviews are conducted on the basis of a risk based plan approved annually by the Audit Committee. This includes regular visits to each division, shared service centres and plants. The findings and recommendations from IA are reported on a regular basis to the Executive and Audit Committees.

- An annual internal control self-assessment, with management certification, is undertaken by every Bodycote site. The assessment covers the effectiveness of key financial and compliance controls and was revised at the start of 2017. The results are validated by IA through spot checks and are reported to the Executive and Audit Committees.

- Group Core Values and Group Policies (including the Code of Conduct, Group Authority Matrix and Finance Policies) are documented and are available to all employees via the Group's intranet system.

- The Chief Financial Officer, Group Financial Controller, President and Vice President of Finance for each division sign a letter of representation annually. This is to confirm the adequacy of their systems of internal controls, their compliance with Group Core Values and Group Policies, relevant laws and regulations, and that they have reported any control weaknesses and actual, or attempted, frauds or thefts through the Group's assurance processes.

- A Group-wide risk register and assurance map is maintained throughout the year to identify the Group's key strategic and operational risks. Any changes to these risks during the year are promptly reported to the Executive Committee and the Board.

During 2017, in compliance with provision C.2.1 of the Code, management performed a specific assessment of its risk management processes for the purpose of this Annual Report. Management's assessment, which has been reviewed by the Audit Committee and the Board, included a review of the Group's key strategic and operational risks. The review was based on work performed by the Group Head of Risk and the Group's Risk and SHE Committee (by means of workshops, interviews, investigations and by reviewing departmental or divisional risk registers). These risks have been reviewed throughout the year and two new risks have been added since 2016, Environmental and Capital Projects. Further information regarding the ways in which the principal business risks and uncertainties affecting the Group are managed is shown in the Principal risks and uncertainties.

Investor relations

The Group Chief Executive and Chief Financial Officer regularly talk with and meet institutional investors, both individually and collectively, and this has enabled institutional investors to increase their understanding of the Group's strategy and operating performance. In addition, internet users are able to view up-to-date news on the Group and its share price via the Bodycote website at www.bodycote.com. Users of the website can access recent announcements and copies of results presentations and can enrol to hear live presentations. On a regular basis, Bodycote's financial advisers, corporate brokers and financial public relations consultants provide the directors with opinion surveys from analysts and investing institutions following visits and meetings with the Group Chief Executive and Chief Financial Officer. The Chairman and SID are available to discuss any issues not resolved by the Group Chief Executive and Chief Financial Officer. On specific issues, such as the review of remuneration packages, the Group has sought, and will continue to seek, the views of leading investors.

By order of the Board:

U.S. Ball

Group Company Secretary

6 March 2018

Springwood Close

Tytherington Business Park

Macclesfield

Cheshire

SK10 2XF