Operating an international network of facilities, Bodycote is the world's leading provider of thermal processing services.

Experienced in supporting large multinational customers and their supply chains, as well as local niche specialists, Bodycote provides a vital link in the manufacturing process for virtually every market sector including aerospace and defence, automotive, power generation, oil & gas, construction, medical and transportation.

Our structure

The Group operates 187 facilities around the world which are organised into customer focused divisions:

The ADE Divisions

(primarily focused on aerospace, defence and energy customers)

Read more onThe ADE Divisions

The AGI Divisions

(primarily focused on automotive and general industrial customers)

Read more onThe AGI Divisions

Throughout this report you will see illustrations which link our business and strategy:

Strategy & Core Values

Aerospace, Defence & Energy

Automotive & General Industrial

Key Performance Indicators

Return on capital employed

Headline earnings per share

Headline operating cash flow

The core values underpinning everything we do

Honesty and Transparency

We are honest and act with integrity. This is not something we take for granted. Bodycote lives by a culture of honest and transparent behaviour, which is at the core of all our business relationships.

Respect and Responsibility

We manage our business with respect, applying an ethical approach to our dealings with those we interact with. We believe in taking ownership, and being mindful of the impact of our actions.

Creating Value

Creating value is the very essence of our business and needs to be the focus of our endeavours. We create value for our customers, our employees and our shareholders.

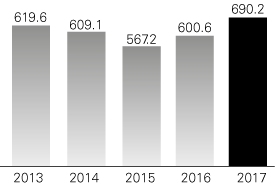

Revenue

£m

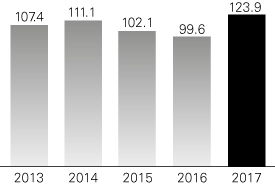

Headline operating profit

£m

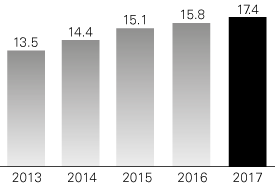

Dividend per share

pence

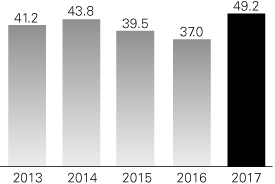

Headline earnings per share

pence